An affiliate of the National Hockey League’s Pittsburgh Penguins selected Buccini Pollin Group to transform 28 acres of surface parking lots across Centre Avenue from 18,000-seat PPG Paints Arena into a $1 billion mixed-used district. BPG is working closely with several redevelopment partners on the site of the old Civic Arena, including award-winning design firm Gensler, locally-based First National Bank and lead residential developer Olmec Development – a Pittsburgh-based, minority-owned housing developer.

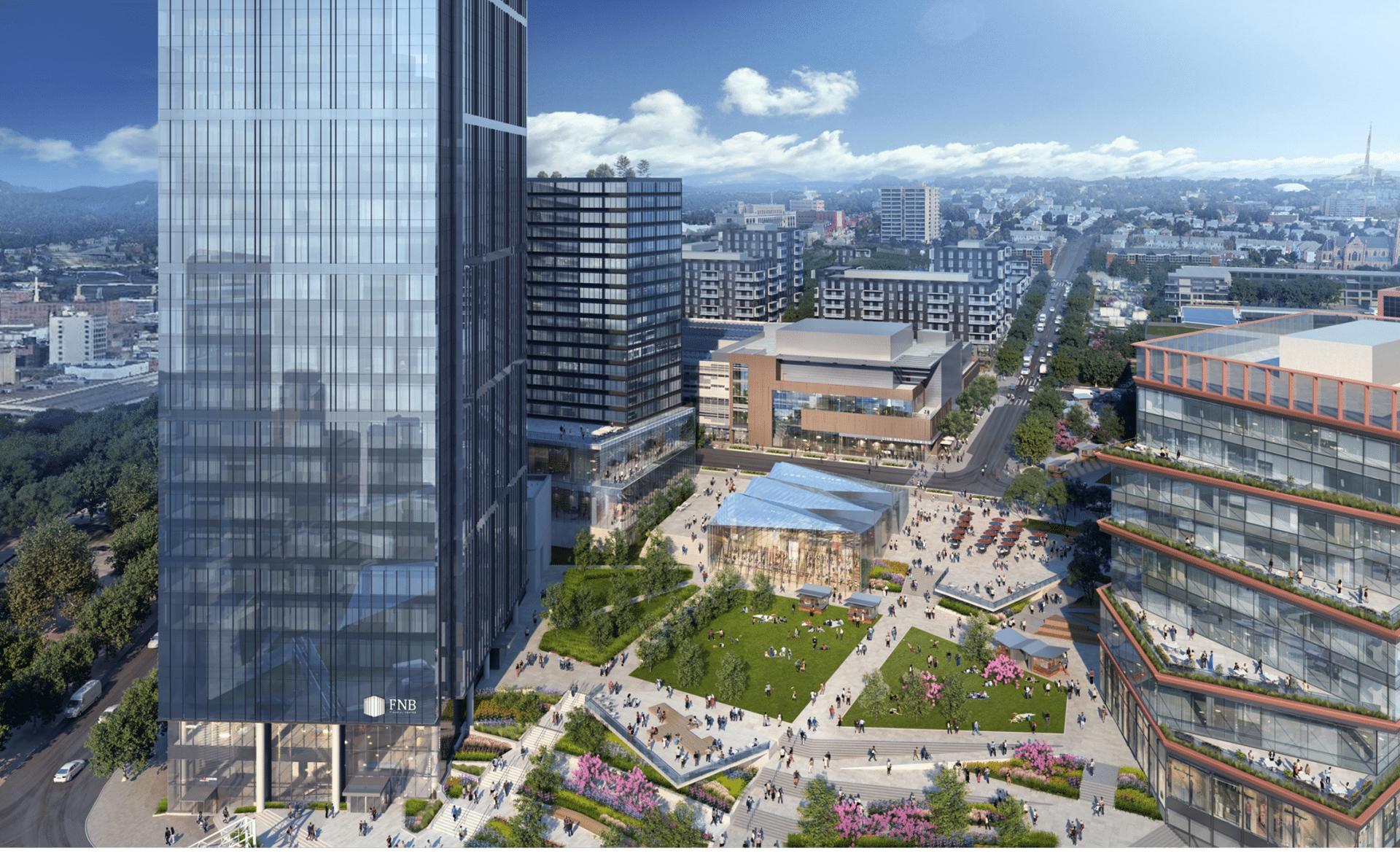

The Lower Hill District will offer a unique blend of residential, commercial/office, retail/entertainment, and food venues, redefining urban living and vibrant workspace in the heart of Downtown Pittsburgh. The new master plan, a testament to our commitment to innovation, calls for over 800,000 square feet of office, 200,000 square feet of retail including a state-of-the-art entertainment venue, a 220-guestroom hotel, and over 1,000 new residential units. The Gensler-designed plan features an 8-acre greenway including the recently-completed $30 million highway cap and parkland above Interstate-579. Each development block in the district will feature new buildings with ground-floor retail/commercial suites and access to dynamic outdoor areas. The site, with its excellent access to public transit and major traffic arteries, offers some of the region’s best views of the Downtown, North Shore, and Mount Washington.

Where passersby once peered out over fields of surface parking, the 26-story Class-A FNB Financial Center now connects the Historic Hill District neighborhood and Downtown’s business district. The $250 million tower, both LEED Silver certified and equipped with SMART technology, is a momentous opening statement for the project. It is slated to open in mid-2024 and will be Pittsburgh’s first modern, multi-tenant high-rise in four decades. The project’s commitment to community reinvestment is another hallmark of the development. The project delivered over 75 contracts across predevelopment and construction, nearly $50 million in commitments and over $35 million paid to date to minority and women-owned businesses. The Lower Hill team developed a unique financial process that redirected property tax abatements from the developers into a community-directed fund. By monetizing the tax incentive up front using a loan, the team delivered more than $7 million into the Greater Hill District Neighborhood Reinvestment Fund upon breaking ground. Among other things, the fund will be used to support urgent property improvements for existing neighborhood residents and gap funding for community-led, mixed-use development across the Greater Hill District.

For information on leasing:

Cadence Real Estate Advisors

Ken Kearns, kk@cadence-advisors.com +1 610-639-1302

Brendan H. Kelley, bk@cadence-advisors.com +1 215 820 3828

JLL

JC Pelusi, jcpelusi@am.jll.com +1 412 208 1403

Mike Nelson, mnelson@am.jll.com +1 412 208 1400